Boost Your Cash Flow in 2024 with These “Self-Management” Tips

Want more cash flow with less stress while running your rental property portfolio? Then you need self-management! Amelia McGee and Grace Gudenkauf, seasoned investors and the minds behind BiggerPockets’ newest book, The Self-Managing Landlord, show you exactly how to do it. This episode peels back the curtain on the misconceptions that scare most investors away from self-managing their properties (like those feared 2 AM toilet emergencies!). Amelia and Grace expose how these scenarios are less frequent than most people think and offer smart strategies to handle them effortlessly.

The duo dives into the financial perks of taking the reins on property management, from dramatically cutting costs to boosting tenant retention and cash flow. They lay out a spectrum of management models—from DIY to hiring a dedicated team—and share their personal triumphs (and trials) within each approach. This is THE practical playbook for making property management a cornerstone of your real estate success.

You’ll learn how to establish effective systems for tenant onboarding, routine maintenance, and urgent repairs, ensuring your property management is both stress-free and profitable. Whether you’re just dipping your toes into real estate investing with your first property or looking to refine your existing portfolio, this episode is packed with actionable tips that promise to make your portfolio more passive!

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Ashley:

This is Real Estate rookie episode 401. How can you increase your cashflow in 2024? Reducing expenses is one key way and it may not be as time intensive as you think. My name is Ashley Care and I am here with Tony j Robinson

Tony :

And welcome to the Real Estate Ricky Podcast, where every week, three times a week we’re bring you the inspiration, motivation, and stories you need to hear to kickstart your investing journey. Today we are bringing back to real estate Ricky Alums. We have Amelia McGee who was on episode 111, and we have Grace Guten Ka was on episode 161, and these two ladies are the newest authors for BiggerPockets. So if you guys have her to biggerpockets.com/managing book, you can see their new book that just launched, but we’re excited to talk to them both and really the premise of today’s conversation is why investors get it wrong with handing off their properties. And also what are some of the risks of self-managing and what goes into onboarding tenants and so much more. So ladies, Amelia Grace, thank you so much for coming back. Welcome to the Real Estate Rookie podcast for the second time.

Amelia :

Thank you so much. We’re super excited to be here.

Grace:

Thank you.

Ashley:

Okay, so Amelia, let’s start with you. What is one big misconception that people have that maybe keeps them up at night as to a reason they don’t want to be a self-managing landlord? Yeah,

Amelia :

I hear this reason over and over again. It is that they’re going to get that 3:00 AM leaky toilet phone call, a tenant having an absolute panic attack over some sort of a maintenance request. And honestly, the only landlord that I know that’s ever received one of these calls is Grace. So maybe Grace can share her story on that, but she’s actually the only person I know of that’s had to go through that.

Grace:

Yeah, it’s the infamous leaky toilet call. I’ve only had it once. We can dive into that story if we want, but in general I think people are overly freaked out about all the things that could happen instead of focusing on all the great things and the things that they can do to prevent anything bad happening.

Ashley:

So what is the kind of ratio of the chance of that happening? Do you just have one property that you’ve owned for a week and you already got that nightmare call? Kind of give us an overall view of how slim of a chance that is happening.

Grace:

I mean between the two of us, we have I think 65 properties and we’ve had one of the leaking toilet in the middle of the night call. So the odds are less than 2% I would say. And also like Amelia said, I don’t know anybody else who’s had it. I don’t know why this example is the one that is so popular, but in general, not very likely.

Ashley:

I recently went to self-managing, I self-managed, and then I outsourced to a property management company for three years. And now I’ve come back and I related so much to the book you guys have written because you talk about there’s three options to self-manage where you’re doing everything. There’s hiring a third party property management team, and then there’s also hiring your own property manager that works for you and kind of building your own team. And that’s what I’ve done the last year. And I really want you to touch on those three different things and how they actually compare and how they are different.

Amelia :

So the first one that everyone thinks of is self-managing and you’re running around a chicken with your head cut off, you’re constantly fighting fires, you’re doing things the old school way, the mom and pop way of accepting rent in any way, shape or form. You’re getting phone calls and text messages. You have really no system. So that’s the first option that a lot of people think of. The second is property management companies. And just to be blunt, I think I’ve heard probably 95% property management company horror stories over successful stories. A lot of people don’t love property management companies and that’s just because they have to have so many properties under management to actually make a profit. It’s hard for them to provide good quality service to all of them. And the in-between option is being an organized and systemized property manager that hires an internal person to be on your team, whether that’s part-time or full-time that does a lot of the brunt of the work for

Tony :

You. I love that middle ground. And just like Ash, we’ve kind of built out our own management team internally as well, and I do think there’s a lot of benefits to that. And personally, I’m super excited for this episode to hear more about the systems and processes you set up on the long-term rental side to see if there are any things that I can maybe steal for our short-term rentals because it is a slightly different approach when you’re dealing with guests versus tenants, but I hope some of those foundations are still the same. I think maybe zooming out just for our listeners to maybe get a good foundation here, but when we talk about the word landlord, what exactly are the responsibilities of a landlord and grace, let’s start with you.

Grace:

A landlord is a lot more than a lot of people realize. First of all, you’re going to be managing the tenant and leasing and advertising, collecting rent maintenance requests, but there’s the second part a lot of people forget about and that’s being the business owner, that’s the bookkeeping and any of the marketing and any of the tax work or legal work. So when people think about doing this job, we really want people to think about, Hey, you’re a business owner, not just somebody who leases a property.

Ashley:

That’s so true. It’s not just, oh, you’re getting a rent check and you’re paying the mortgage and you own a rental property and you’re getting a text once in a while to have a maintenance guy out. There’s so much more involved in that. So what are some of the actual risks of being a landlord? Sure.

Amelia :

The first one is the tenants. It’s really important for you to onboard great tenants. That’s one of the hardest parts of the job and just the interaction that comes with having tenants in your properties is a risk. Another is managing. I think that’s another rookie fear that a lot of people have is, well, how am I going to get a handyman in the property or how am I going to manage projects? Another is the middle of the night leaky toilet call. So those emergency maintenance requests, how do you handle those? People are always thinking about the what ifs and we’re big fans of proactive property management, so we already have plans in place for when emergencies may come up. And another huge one is the emotional side of the business. So this is very much person to person type of business. There’s a lot of emotions involved. Tenants are going to have things that come up in their life, you’re going to have things in your life. And so just being able to balance that. And then the last one that we think of is the legal risks associated with anything that has to do with owning a property. So leasing, tenant complaints, any of the laws and regulations that surround rental properties, those are all factors that come into play. What

Ashley:

Are some ways that you can actually mitigate these risks? You kind of mentioned you have the processes, the systems in place. Can you maybe go into a little more detail of how someone can mitigate the risk?

Grace:

Honestly, the biggest thing is being proactive. When you’re running around in the day-to-day and you haven’t thought through how you want to handle things or run your business, you’re making emotional on the fly decisions and you’re letting things slip through the cracks and that’s what creates risk. When you’re able to look at things like a business owner and preemptively, think about, okay, what is my tax strategy? What is my legal plan? How do I make sure that I get great tenants into this next unit? You’re already preventing most of the risk and real estate is always going to have risk. It is a risky business, but there’s so many things that you can do to prevent that. If you just take a second to get organized, think ahead and have a plan.

Ashley:

Okay, we’re going to take a short break. Thank you so much for everyone listening for taking the chance to check out our show sponsors. Grace and Amelia have talked to us about what it takes to be a landlord, what’s involved and also what are some of the risks and how to mitigate it. So stay tuned where we’re going to come back and we’re going to be talking about the benefits of actually being a landlord. Welcome back from our short break. We are here with Grace and Amelia, before we get into tenant onboarding, we’re going to be talking about some of the benefits of actually being a landlord. So Amelia, what are some of the benefits as to why someone would want to be a landlord? Yeah,

Amelia :

I think the first benefit of choosing to self-manage your properties is definitely the monetary aspect of it. Typically when you hire a property manager, you’re paying anywhere from 10% of gross monthly rental income plus lots of additional fees, fees, lease signing fees, setup fees, et cetera. So that’s obviously a huge benefit and I both self-managed our portfolios up to over 50 units and that’s because we both wanted to quit our full-time jobs as soon as possible. So we needed every single last penny in our pocket. So that’s definitely the first one.

Ashley:

Tony, when you did your first long-term rental, did you have a lot of these fees that Amelia is talking about and were there any that maybe you didn’t expect that came up and kind of hurt your cashflow from your property manager?

Tony :

Yeah, we definitely, we had a lease up fee for sure, which I think was like 50% of one month’s rent. I think it might’ve been even a full, it was a crazy amount. I was like, holy crap. So there was a lease up fee, but what really hurt us was all of the maintenance fees that they charged. So in addition to having the property management company, they also had their own maintenance company and the only quotes they would give us was from their own maintenance company. So if I wanted to source from someone else, I had to do that work myself. And I wasn’t really, I was new, I didn’t really know what I was doing, so I usually just went with their management company and honestly I paid more to their maintenance company than I did to the management company.

Ashley:

How much do you think your cashflow would’ve increased if you would’ve, how much do you think on average you’re paying out a month?

Tony :

I don’t know. I think when I did the math, I was averaging like 150 bucks of cashflow in that first single family home. And had I brought back the management fee and maybe reduced some of those maintenance expenses, I mean it easily would’ve doubled over the course of a year.

Ashley:

Grace, what about you? Have you ever shopped around to see how much you’re actually saving by self-managing to increase your cashflow?

Grace:

Yeah, and the other thing you have to remember is a lot of management companies will charge you whether they collected rent or not. I just heard somebody talking about this, so don’t forget that even if your tenants aren’t paying a lot of times you’re still going to be charged for it, which is never fun. But Amelia and I did the math the other day on exactly what we would be paying currently if we had a PM for our entire portfolio and it was for Amelia, she’s saving like $60,000 a year. If she was paying 10% for long-term and midterm 15% for me, I would be paying I think it was like $30,000 a year for 10% long-term and 15% midterm. And internally we pay, Amelia pays $500 a month and I pay $1,200 a month, which is a fraction of what my full-time person’s entire job description is. But in Iowa, that is more than a nice salary, especially for Amelia’s portfolio that you can really stretch a long ways if you can keep that in house and you’re going to double the quality for your own portfolio and for your tenants.

Ashley:

Yeah, that’s such a crazy difference. And I think right there, that price point is someone looking into considering taking the time to build out the system and processes to actually make that happen because I’m sure that didn’t happen overnight and we’re going to get into that as to how you guys built out these well machines. So Amelia, please continue. What are some of the other benefits of being a landlord? Yeah,

Amelia :

The second is just the quality of service that you can provide to your tenants. Owning rental properties is very much a customer service based business, whether that’s long-term, midterm or short-term. And your goal as a landlord is to provide the best services possible so that you keep your tenants happy and in turn they stay for as long as possible because the number one cashflow killer in real estate is vacancy. If you have a property that’s sitting vacant for a long time because you just can’t find a good tenant or you can’t keep your tenants happy, that’s really going to affect your bottom line. And the third is that you’re going to need to learn how to property manage anyways, because when people hire out property management, they think that it’s set it and forget it. They’re never going to have to do anything ever again. And that’s just not the case. You’re still going to have to manage the property management company, you need to hold their hand a little bit, tell them how you want things run. So it really isn’t as people think it is,

Ashley:

I have to 100% agree. I did not realize I would have to be an asset manager. When I turned it over to a property management company, I thought like, oh my god, this feels great, just a weight off my shoulders. But I did not realize there is a full job that comes along with outsourcing. You still have to be the asset manager. No one is going to notify you and say like, Hey, your insurance went up a little bit. You should probably shop around. I’m going to shop around for you, get you a better quote. Or you know what, your water bill went up, the toilet might be leaking or something like that or running. But that’s a great point.

Amelia :

And all those little things really add up and that’s another part of being a business owner is looking monthly at all of the things that you’re spending money on, those utility fees, your insurance, your property taxes and analyzing them from a business perspective and are you even making money on these rental properties anymore? So asset management is huge.

Tony :

Yeah, just one point on that, we have a meeting with my team maybe once every other month where we review all the p and ls for our portfolio and it had been a couple months, it was like right after our last daughter was born, so we didn’t have this meeting for three months. So we had the first meeting of the year and we’re looking back the past four months and we see one property just has super high energy costs and we’re like, what the heck is going on with this? We ended up digging into it and because we have so many properties in one city, we have one account for all the properties, but separate billing, we found out that one property was billing another property for their energy costs. There was no energy costs on one property, double on the other one, and we wouldn’t have figured that out had we not dug into the finances. So just ty into what you’re saying, Ash, if even if you have a property manager, no one’s going to be doing that level of digging for you to catch those kinds of things.

Ashley:

So Grace, tell us a little bit about the actual onboarding process of getting these tenants in place. So once you have your property, how important is that? And you guys touched a little bit on the customer service piece that having a vacancy is going to kill you. So please go ahead and explain that process that you guys have put into place.

Grace:

When we first started, our mindset was do as little as possible, just get ’em in, don’t spend a ton of time going over everything so that they can just get in and not be annoying. And now we’ve completely shifted 180 to where we want to have in-person signings where we can go through everything that’s in the lease with the tenant so there are no surprises. So when they do move in their random Uncle Sam, they know exactly that they cannot have somebody in the house that’s not on the lease longer than X amount of days or when we go to do a maintenance request and it turns out it was a tenant caused issue, they know exactly that they’re going to be paying for it because we want everybody’s expectations to be the same. We want our tenants to be happy and stay there for a long time like Amelia said, so that we can cut down on our turnover and make more money and that they can have a home. But I think the biggest thing to realize with property management is the onboarding is so, so important. We’ve had a lot of lessons learned and don’t skimp

Ashley:

It. Amelia, is that similar to how you have experienced the onboarding process?

Amelia :

Yes, absolutely. And I think even before onboarding starts, just having a really comprehensive screening process and knowing your requirements ahead of time and sticking to those, when you onboard a tenant, this is not an emotional decision. You should have a credit score requirement, a background check requirement, landlord references, et cetera. And we actually talk about all of that in the book, so I’m not going to go through all of it, but it’s really important to stick to the guidelines you already have laid out so you’re getting a really high quality tenant in your property and then you continue to set expectations after that, during the actual onboarding process.

Tony :

I want to know a little bit more about the actual onboarding process that you guys have laid out because like you said, I think a lot of people, myself included, leverage virtual assistants and automation to do a lot of the heavy lifting when it comes to managing your properties, but there probably is some benefit in a little bit of face-to-face connection and kind of walking people through things. So at a high level and grace man, we’ll start with you, what does that onboarding checklist actually look like?

Grace:

Two key things that I do that I didn’t do before is one, I have them do a practice maintenance request in the software so they know exactly how to do it and they don’t try to call or text or email. They know exactly what the process is with lots of pictures and videos and descriptions so we can solve it right the first time. And the second thing I do differently is I used to give them a move-in inspection report and just say, if you have something to report, let me know. And so 99% of the time nobody would report anything, so there wasn’t actually any proof of what the moving condition was. Now I make sure when they move in, we are there doing that move inspection together so we’re all on the exact same page with pictures and videos and assigned report of exactly what the condition of the property is because as much as we want people to stay for a long time, the longer people say the harder it is to prove what the condition was at the very beginning. So my checklist just looks like all the things that I need to do to make sure that the landlord tenant relationship is going to be very smooth. We know how our working relationship is going to go, the property management software, all of that good stuff.

Tony :

I love the idea of making them do the test maintenance request with you because the worst thing is them calling you like you said in the middle of the night for a leaky toilet when all they have to do is put in the maintenance request. So I guess I’m curious, right, when you guys are dealing with tenant who’s been there for a while, and like you said Grace, sometimes it’s hard to know if it was like that when the guest moved in or if it was a tenant related issue. How do you guys, and Amelia, maybe you can answer this question for us, but how do you guys deal with when maybe there’s a disconnect and the tenant’s like, Hey, you as the landlord need to fix this versus you thinking that the tenant might be responsible for that maintenance issue?

Amelia :

That’s a good question. It’s a fine line and I feel like as landlords we have to err on the side of caution. Unless you have clear evidence that whatever the issue was was caused by the tenant, you probably are going to be on the hook for paying for it. I would rather keep a tenant happy pay for it myself unless I can really concrete prove that it was their fault.

Grace:

I think one thing we both do well is making the lease the bad guy and always pointing back to the source of truth of, Hey, it’s not me saying you need to pay this late fee or that you have to pay for this broken window. It’s actually the 10 sheet long piece of contract that you signed and I have to treat all of my tenants fairly. So no, I can’t make an emotional one-off decision for you. I’m sorry, it’s not me, it’s the least.

Ashley:

I want to touch on something real quick to kind of get everybody listening excited about what you guys are talking about as far as taking the time to build out this system because I’m going to take a guess and I’m going to say at this point and your business, none of your tenants have your cell phone number. No.

Amelia :

No.

Ashley:

Yes. And that’s a why I want to highlight that is to, that’s a really exciting point to get to as a rookie investor where you are not actually the one physically communicating on your phone or texting them that there are other ways to navigate that, whether it’s through property management software or it’s through using a va, all these different things. So just as you guys were talking, I was thinking about that as you’re saying the systems you’ve implemented and how you handle things that you’re not even having to be the bad guy anymore. It’s not you physically saying it on the phone to the person. So let’s go into the importance of the lease agreement. I’m currently this property right now that it’s a five unit and four of the people don’t even have lease agreements in the place. So tell us how important is it that I get a lease agreement in there right away? Okay,

Amelia :

So I’m actually going through a situation with inherited tenants right now that did have lease agreements, but oh my gosh, even up to this point I have 41 doors and Ashley, you have quite a portfolio too. I’m still learning new things and the lease is so important, it protects you, it protects the tenant. We recommend that you use a local attorney that knows the local laws in your area and that knows your property specifically. So we do a lot of midterm and long term. So we have different leases for our midterm and our long term and we have attorneys that help us draft those. And I know it’s another expense, man, owning real estate is expensive. There’s all these little fees that add up and add up, but I would totally recommend if you’re going to spend that extra $500, make it your lease. And also just another quick note, if you’re inheriting tenants, sign a month to month lease with them for the first six months, run background checks on them, run credit checks on them, make them go through the whole process that you would any other tenant because I’m currently going through something that is biting me in the butt because I did not follow my procedures on that.

Amelia :

I actually didn’t even have procedures. Now I do, but inherited tenants, you got to put ’em through the ringer too.

Ashley:

Yeah, that is a great point. I never thought about adding in that step of actually making them go through basically the application process as they’re becoming my tenants. So yeah, that’s a great point. The only other things I’ve done in the past is do an estoppel agreement where I’m verifying what the landlord is saying and what they are saying. And I think adding in that piece of having them go through the application process. And then also I really like just doing a month to month lease to start and to kind of give them that trial basis to see how they work out. And then where are some places that someone could find lease agreements? I think it’s a freebie with your guys’ books.

Amelia :

So if you order our book, you get access to state specific leases and a whole bunch of other landlord specific things in our lovely landlord packet and it’s got a ton of information in there for you, but take that lease and then have an attorney just double check it to make sure that we’re not missing anything.

Tony :

One follow up before we move on from this topic of leases and screening rescreening existing tenants. So say Ashley, with this property that she’s looking at, there’s no leases in place and she does the background check, the normal application process and maybe this person doesn’t pass. I guess Amelia Grace and maybe Grace, we’ll start with you. What would your process be if that person didn’t pass? Are you giving them notice that they have to or what do you do if they don’t pass? Well,

Grace:

First of all, you need to define what is pass and that’s something I’ve not done for myself, but exactly the credit score and the income requirement and the landlord verification. And for me, yeah, I always post a notice no matter what. Even if it’s a situation where a tenant’s telling me, Hey, I’m going to be late, I let them know I have to post the notice according to the lease and to keep everything fair as long as you pay within that time, don’t worry about it, it’s just paperwork. Thanks for letting me know. But that way you’ve already started the procedure of an eviction if you have to, which try to avoid that at all costs. But that’s what I would do with any of the tenants who are inherited is let them know from the beginning what it’s going to look like and be clear with them. So that’s not a surprise of these are my requirements. If you don’t pass it, you’re going to have to have a notice. Obviously you can work with them a little bit if they need some extra time or to move out, I would do that, but I would post a notice right away.

Tony :

Amelia, same for you or any differences there? Yeah,

Amelia :

So again, this comes back to taking the emotion out of owning rental properties. So you have to have your systems and processes that you abide by and if you inherit a tenant that doesn’t meet your requirements, it’s tough. But I would say you have to serve them that notice and get them out. I will tell you from experience that you will save money in the long run by onboarding tenants that meet all of your requirements rather than just taking the easy route and keeping those inherited tenants that are maybe paying their rent every month, maybe late some months, et cetera, but have other baggage that comes with them. And I’m not ragging on inherited tenants, but I mean there’s just things that come with them.

Tony :

If we can talk about that just a little bit, maybe the tenants who they’re pain but they’re just kind of like a pain in the butt to manage. Have you guys found maybe a creative way to deal with those type of tenants? What’s working for you there?

Grace:

Amelia and I always call this the happiness clause. If you are dealing with somebody who it’s like no matter what you do, you cannot make them happy. We tell them, Hey, it seems like you’re not happy. We’re happy to fix X, Y, and Z, but if you want to move elsewhere, we’re happy to break this lease because we want tenants who are happy and living in this unit and probably majority of the time they stop complaining like, I don’t want to move. I actually love it here. I just was bored and had all these complaints and I have had one person move and actually two between all of my long-terms and midterms and it was a blessing that they moved.

Ashley:

Okay, so we’re going to take a short break, but when we come back, I want you to stick around because we’re going to talk about the importance of systems and why Grace unfortunately had an $8,000 bill because her process wasn’t dialed in, and we’re also figure out how to do all of this without giving yourself a full-time job. We’ll be right back. Okay, we’re back from our short break. Thank you everyone for taking the time to check out our show sponsor. So Grace, I’m intrigued. Please tell us about this very expensive cost of $8,000 that you had to pay.

Grace:

Yes, it was a bookkeeping expense because when I first started all of my rental properties and my burrs, I forgot that it’s also a business and you have to keep up with all the business aspects that we talked about earlier. So I had probably 15 to 20 rentals, tons of rehabs, refinances, and I let my bookkeeping slide to the wayside. So when I finally was ready to get it all caught up and get everything systemized, it took me three different bookkeepers over a year and $8,500 to get my books up to snuff. And I know that exact number because now my books are fantastic and I can literally pull that exact number from my QuickBooks, but it just illustrates to those who are starting real estate. I’m not saying that you need to go hire a bookkeeper, but you do need a bookkeeping system from your very first property. Maybe it’s once a year, maybe it’s once a quarter, but you have to do it.

Ashley:

Grace, when you found, you decided it was time to actually implement that. How much did it slow down your acquisition piece at all? Because now you had to really, really focus on that bookkeeping portion and get that cleaned up before you could even go and acquire more properties?

Grace:

Absolutely. It took all my mental energy, it took a big chunk of my money, $8,500. It took so much of my time because I had no systems of where my utilities were or which LLC owned what property or which tenants were where. So my bookkeeper had to almost pull this information out of me. Now I have a beautiful system where everything’s in all these nice quick guides and really filed in a nice way. And in fact, I filed my taxes on time this year, which is crazy. And my CPA said, wow, that was a really nice LLC overview you gave me. And I thought that was the best compliment ever. I thought about it all day, but I was absolutely not like that. Two years ago everything was in my head or on a sticky note or maybe I had to scroll back in my text messages or find an archived email. There was no system.

Ashley:

I just want everyone listening right now to, if this is Grace is describing you right now, you need to admit that you need help right now and you need to go and find some help with this because it can stop you from growing and scaling. But not only that, you can also get into legal financial you to get the IRS coming after you. There’s so many different things that can affect your bookkeeping, even though it seems like such a small piece. It really is so important to your overall business, and it

Tony :

Sounds like the biggest change that you guys have been able to make is just implementing the right systems and processes, which is so important as you start to build your business. We had some of those similar growing pains as we scaled up our portfolio as well. We went from three Airbnbs to 15 over the course of 12 months, so we had a lot of properties to our portfolio. And when you’re scaling that fast, sometimes those underlying systems don’t necessarily scale with you. So we went through some of that growing pain as well. But I’m curious, what are the SOPs or the standard operating procedures look like in your business today? And if for our rookies that are listening, maybe where should they start when it comes to building out those SOPs? And Amelia, we’ll start with you on that one.

Amelia :

Yeah, so we have SOPs for everything in our business, and if you’re a rookie investor, I know a lot of this seems very daunting and it seems like, man, why would anyone ever self-manage this sounds terrible, but honestly, it doesn’t have to be that way. It really isn’t. But we have an SOP for tenant onboarding. We have an SOP for listing our properties. We have an SOP for what happens during the closing process. Don’t forget to get insurance and turn your utilities on. We are so guilty of forgetting that every single closing until the day of, but we would recommend starting these SOPs from the very beginning. That is one thing Grace and I both did wrong. And for me personally, I grew very quickly. I had 26 doors after one year, and I actually didn’t buy a single property in 2023 because I was so disorganized. I had to spend a whole year just getting caught up, creating those SOPs, just getting organized. And so if you’re listening and you’re about to buy a property, or maybe you just have one or two properties, get organized right now, start documenting everything you’re doing, and if an SOP sounds daunting, call it a checklist, just start writing things down. It doesn’t have to be a whole big sheet of paper that has every little step, but start just documenting the process as you’re going through it the first time.

Ashley:

What are some different softwares or tools that someone could use to help them build out an SOP?

Grace:

There are a few different things. You could use Loom to record videos and maybe have a VA break down the video of what you’re doing and put it in a Google Doc. When it comes to actually executing what’s in our SOP, we both love monday.com. For example, my acquisition checklist as it relates to anything tax time, tax time. Whenever I buy something, I have to go put that closing statement in that year’s folder of closing statements. I have to go add all those utility numbers to my utility numbers, quick guide, all these different things. So Monday has that checklist all broken down so that I can assign it a due date and assign it a person and make sure each nitty gritty thing happens every single time the same way, the same person so that you don’t have to really think about it, you just do it.

Ashley:

You mentioned a quick guide. What is

Grace:

That? Yeah, so I was talking about earlier how my wifi passwords might be in my phone on my notes in my email written down somewhere. A quick guide is just a really concise way to write out all of your property information. So I have quick guides for insurance policies, door codes, wifi passwords, utility shutoffs, where are those all located so that if there’s an emergency, you know exactly where to tell your tenant. Another quick guide just today I decided to implement is writing all of our appliances and whether they’re gas or electric, so that way when I go to sell a property, my realtor can look at that quick guide as she makes her description and does all the disclosures and just knocks it all off. She has all the information right in one spot.

Tony :

Yeah, I absolutely love Monday. I know Ashley used Monday as well, and it’s a really cool tool to kind of capture all the different information you need for your different properties and much like what you guys have outlined, we have checklists inside of Monday as well. And there’s the top level of like, Hey, here’s the results, here’s the end result that needs to happen and all the steps below. And then we actually link to the Loom videos for each step. So each loom video is, I dunno, two minutes long, but they can kind of break it up into digestible pieces and then there’s any supporting documentation or files, and you will add that in another column as well. So now every time someone on my team does something, there’s a Loom video, it’s showing them what they need to do, and we found that a really easy way to train people as they’re coming into our business and doing different things.

Amelia :

I just wanted to add that one other really important piece of software that Grace and I both use, which isn’t an SOP related software, is our property management software. And I know we haven’t really touched on that too much here, but I hear a lot of newbies that even have 3, 4, 5 properties and they still don’t have a property management software. You need to get that set up with your very first property. It makes you look more professional, it saves you time. Yeah, it might cost you $15 a month, but I think BiggerPockets Pro membership, you get rent ready with that, so you could use rent ready for free. It just makes your business run a lot more smoothly. And you really need a property management software.

Grace:

That’s how you don’t do it as a job. A job is when you have no systems, no resources, so you’re collecting rent by hand, driving around town, chasing down your tenants, calling them, texting them, emailing them. Just think about what is the way I put that in air quotes that you’re going to do something and stick to it, and that’s how you systemize something

Ashley:

During this time that you guys have built these systems to not give yourself a full-time job. Have you relied on team members at all? And as a rookie investor, who are the first team members I should be bringing on to this self-management, property management company and building? Yeah,

Amelia :

We’ve both brought on team members at this point. The first person that I hired out was my bookkeeping because it just doesn’t bring me joy at all. I’m the type of person that has seven months worth of receipts sitting on my desk that I’m going to get to next week. I’m going to get to next week. And so that was the first person I hired out. Grace, we all know that She also hired that out at this point after spending a lot of money on one. And the second is the internal property manager that we haven’t really talked too much about. We talked about it at the beginning, but Grace and I both got systemized. We organized our businesses and then we were able to hand it off to someone else that runs our businesses the way we documented it and the way we want it run.

Grace:

Yeah. Another thing is if you are trying to train your property manager or anybody on your team on what’s in your head, that’s never going to work because they’re always going to have to come back to you to figure out how to do something. Whereas if you have a checklist that you can say, well, what does the checklist say? Or actually we’re going to do it differently this time, I’m going to update the checklist or the SOP. That’s how you figure out how to run a business and actually be hands

Ashley:

Off. Let me ask, how did you go about finding your property manager? Are they virtual? Do they live where your properties are? Explain that process for somebody who wants to take action

Grace:

On that. I found my first internal property manager for 10 hours a week at 20 bucks an hour through a real estate Facebook group that was local. She wanted to learn real estate, so she did my property management for 10 hours a week, all the virtual stuff for about a year after that year. I flipped that into a full-time position with a project management to do my blips. And now that person is full-time salaried. He’s also there physically, but he also had property management experience and was already in the industry.

Tony :

I want to ask one follow up to that grace, because when I think about property management, I feel like it’s hard to kind of corral those responsibilities into 10 perfect hours. So were they not doing anything guest facing or what happened if something happened during the other 30 hours of a typical working week? How would you handle that?

Grace:

Great question. It wasn’t a perfect 10 hours a week. She did know before accepting the job that it’s going to be seven hours one week and 13 the other, and you’re just going to have to keep track of your time. But I know Amelia ran into this with her PM and had a good solution for it.

Amelia :

So I found my property manager through a local Facebook group as well of local investors. So she lives where I live, and she was a newer investor looking to not only learn, but get paid to learn. I think we call that job hacking around here. She’s getting paid to learn. She also gets access to me. So I act as a mentor for her, which I think is a great benefit. I started paying her hourly. I thought that she would work between five and 10 hours a week, and she can work whenever she wants during those hours. It wasn’t like she needs to be on call Monday, one to five or whatever the case may be. So was very flexible. I was paying her hourly. After a couple months, she came back to me and said, Hey, I’m having a really hard time tracking hours because when I respond to a maintenance request or a tenant message, I may be spending five minutes here or five minutes there. I’m having a hard time tracking those hours. So she said, can you just pay me a lump sum every month? And some days, some weeks it might be more than 10, some might be less. It all evens out. And so I said, sure, what do you think you’re worth? She told me $500. I said, that sounds great. Sold. And so that’s how we landed on that. But find somebody that’s looking to learn from you and that has a little bit of experience in real estate,

Tony :

And I feel like I align with that approach as well, Amelia, where you have a little bit more flexibility. So it’s not like necessarily like, Hey, here’s how many hours, but it’s almost like a salaried position where some weeks going to be more, some weeks are going to be less, and sometimes it might be at nine o’clock in the morning. Other times it’s 10 o’clock at night. But you have that flexibility. Ashton know, you’ve obviously been building out your internal management team as well. How does your compensation structure compare to what Grace and Amelia laid out?

Ashley:

So my roles are actually different where I don’t have a property manager that’s boots on the ground. All of the leasing, anything that can be done on a computer is done by a virtual assistant. So she never leaves her desk. She’s on salary. So we do pay her for a set amount of hours. We pay her 40 hours for the week, and that’s also the time she’s on call. So our tenants know they can call her anytime between these hours. She’ll be there to answer the phone. The boots on the ground is actually our maintenance guy. So he actually does the physical showings of the property too, and he does anything that needs somebody there. So tomorrow morning he’s meeting the roofer there to get a quote, things like that. But he started out because he wanted to learn about real estate investing. So it was very similar in that nature. And he did construction. He got laid off in the winter, so for a full winter, he just worked alongside me for free, doing whatever I needed just to learn. And then when it was time for him to go back to work, he ended up coming on to work full time and to take care of all the properties. So similar in that circumstance for sure.

Tony :

Yeah, and I’d say our setup is actually pretty similar on the short-term rental side as well. More so to yours actually, where we have have five EAs on our team right now. But they basically cover, I think 20 hours of the day. There’s like a four hour window early in the morning where no one’s working and we just pay them hourly, but they’re working specific shifts. But that coverage gets us pretty much 24 7. So that’s how we’ve handled in our business as well. But they do pretty much everything virtually, right? Our cleaners and our maintenance crews are the people who are the boots on the ground for us, but our VAs, they’re ordering all the stuff on Amazon, they’re responding to guest messages, they’re coordinating with the plumber, with the HVAC person. So for us, a lot of it can be done virtually for those VAs as well.

Ashley:

Well, grace and Amelia, thank you so much for joining us on this episode, and congratulations on your new book. You guys are also guests on the BiggerPockets Real Estate podcast number 9 3 8 with Dave and Henry. So if you want to learn more about their new book, Self-Managing Landlord, go check out that episode number 9 3 8. You can also go to biggerpockets.com/managing book. Grayson Amelia, thank you so much. We really enjoyed having you guys back on the show. Amelia was on episode 1 1 1, and Grace was on episode 1 61. So you can also go back and check out their origin stories of their real estate investing journey. Make sure you follow us on your favorite podcast platform. You give us a like and subscribe on YouTube and makes you join the real estate rookie Facebook group. I’m Ashley, and he’s Tony. Thank you so much for joining us on this week’s real Estate rookie. We’ll see you guys next time.

Watch the Episode Here

https://youtube.com/watch?v=9bnIZNwPoeg123

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- How to lower your costs and boost your cash flow significantly with self-management

- What being a landlord is actually like, and why it’s not all 2 AM toilet calls

- Building your real estate team so you can handle less of the day-to-day and focus on the big picture

- Practical advice for setting up systems that streamline tenant onboarding and property maintenance

- Grace’s $8,500 bookkeeping mistake that you CAN NOT afford to make

- Tips for handling urgent property issues with WAY less stress

- And So Much More!

Links from the Show

Connect with Amelia:

Connect with Grace:

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

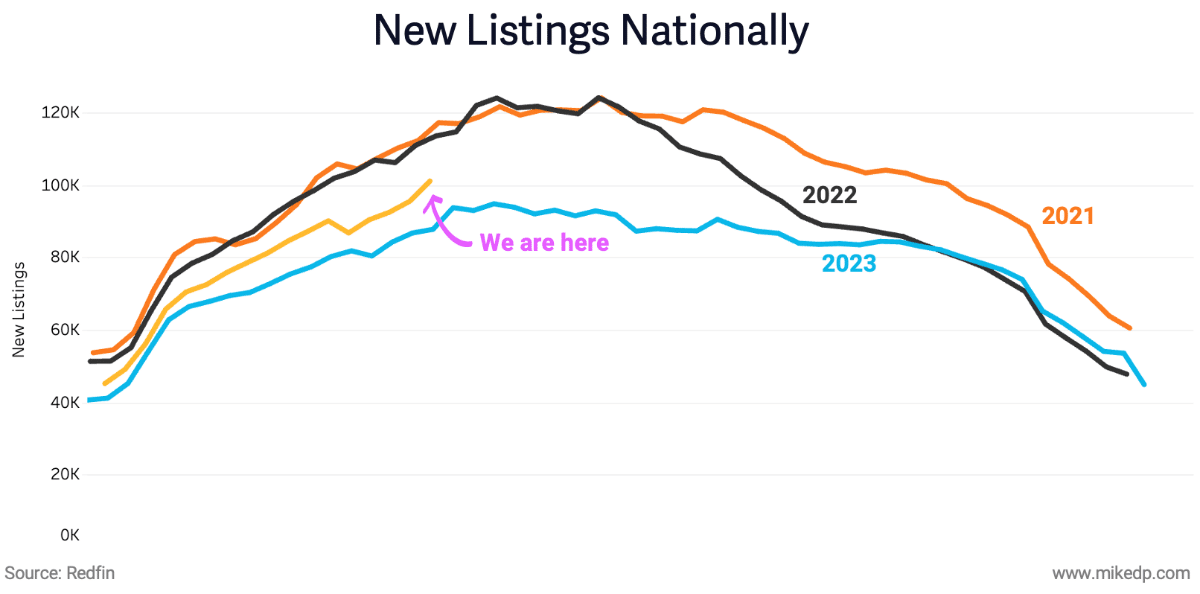

Nationally, new listings are up about 15 percent compared to last year, according to

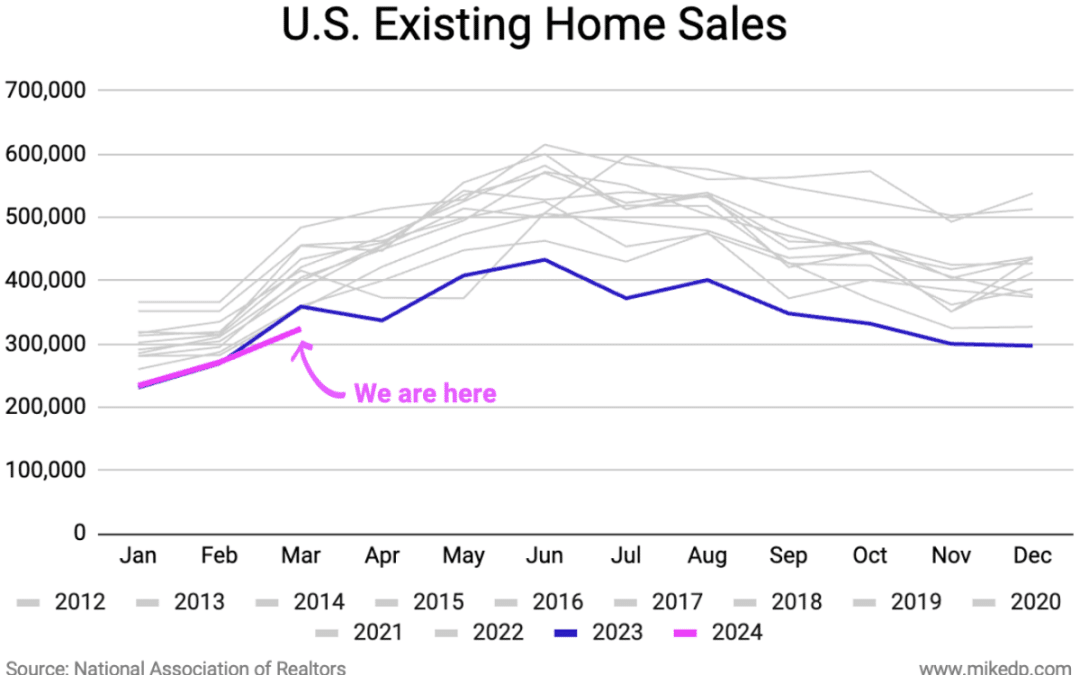

Nationally, new listings are up about 15 percent compared to last year, according to  But new listings are not yet translating into sales, which is

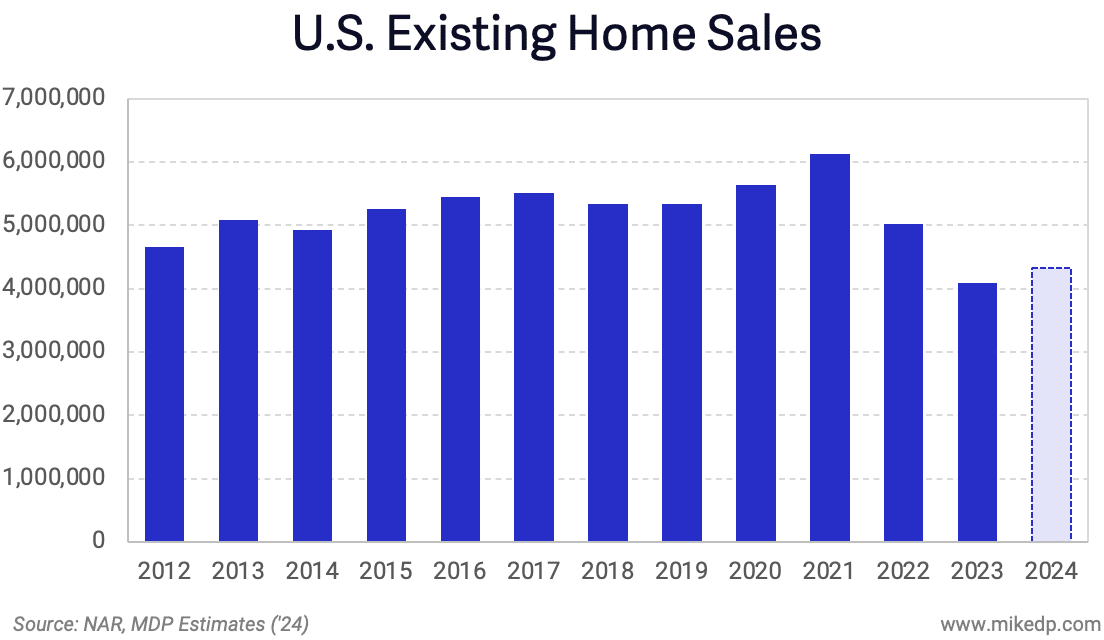

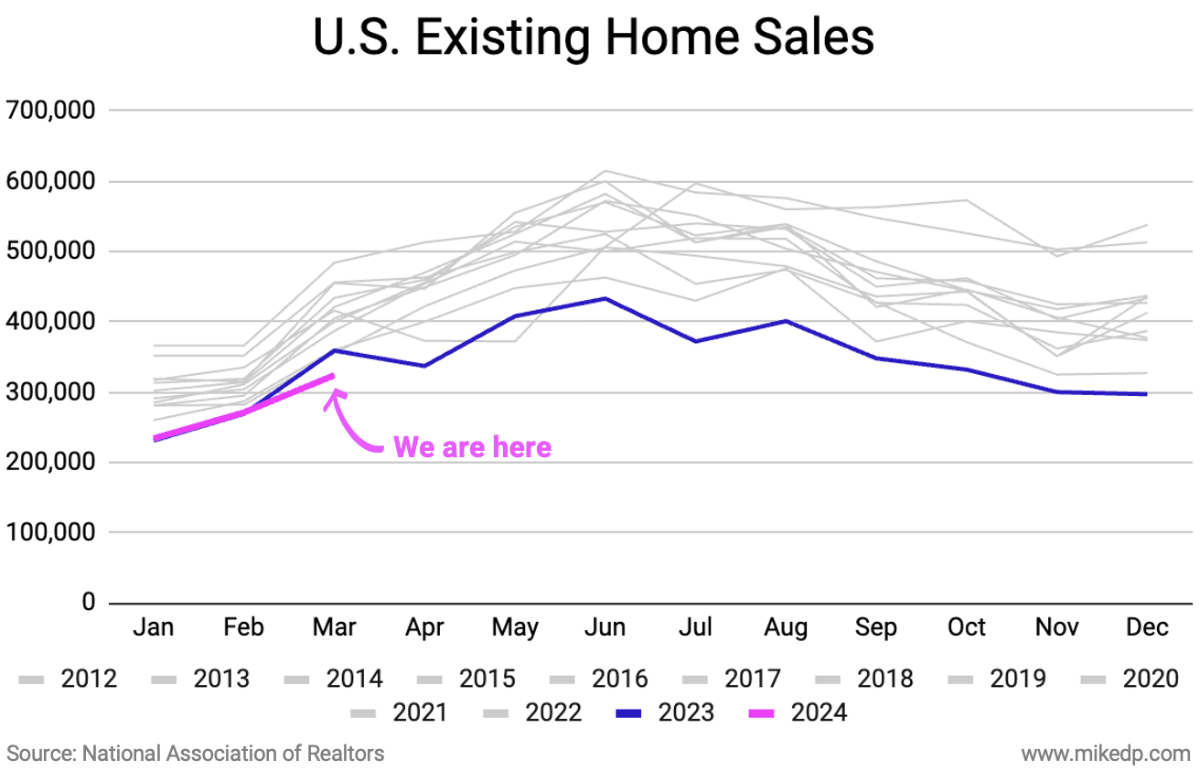

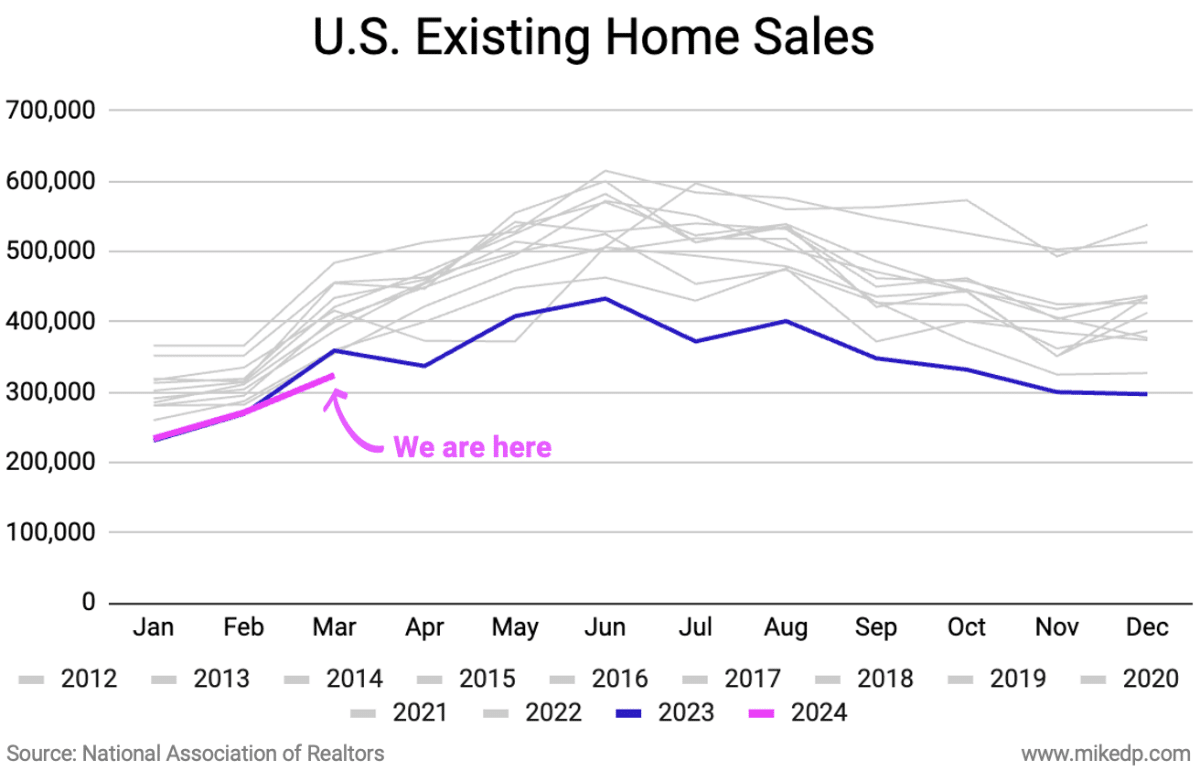

But new listings are not yet translating into sales, which is  For the first quarter of 2024, existing home sales were down 17 percent compared to the pre-pandemic historical average (2012–2019).

For the first quarter of 2024, existing home sales were down 17 percent compared to the pre-pandemic historical average (2012–2019).