On the verge of going private, Doma Holdings is still in the red

San Francisco-based title tech provider, set to be acquired by Title Resources Group, posts a $20.6 million Q1 2024 net loss, down 46 percent from a year ago.

At Inman Connect Las Vegas, July 30-Aug. 1, 2024, the noise and misinformation will be banished, all your big questions will be answered, and new business opportunities will be revealed. Join us.

Having already cut 88 percent of its workforce in two years and sold off its retail title operations, title tech provider Doma’s headway in stemming its losses ran out of steam in the first quarter, with the company reporting a $20.6 million Q1 net loss Tuesday.

That’s down 46 percent from the $42.1 million net loss Doma posted a year ago, but only a slight improvement from Q3 and Q4 2023 when the company reported losses of $22.2 million and $20.8 million.

While Doma is on track to improve on its $124 million 2023 net loss, the company’s accumulated deficit grew to $639.7 million as of March 31.

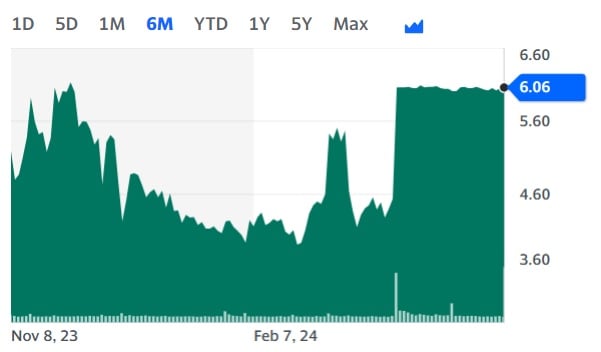

Shares in Doma Holdings Inc., which in the last year have traded for as little as $3.86 and as much as $9.82, closed at $6.05 in light trading after Tuesday’s earnings release, unchanged from Monday.

Doma shares now trading in a tight range

The San Francisco-based company’s shares have been trading in a tight range since the end of March when Doma announced an agreement to go private through a merger with Dallas, Texas-based title insurance underwriter Title Resources Group (TRG).

If the deal closes as expected in the second half of 2024, Doma’s fortunes will no longer be a concern to stock market investors, with TRG planning to acquire all of the outstanding shares of Doma for $6.29 per share.

Doma is allowed to solicit alternative acquisition proposals from third parties during a 50-day “go-shop” period. But funds associated with Homebuilder Lennar Corp.’s LENx investment division, which hold 25 percent of the voting power of Doma’s common stock, have already signed off on TRG acquiring Doma.

With the TRG deal pending, Doma did not hold an earnings call Tuesday or provide forward guidance.

Founded in 2016 with a goal of revolutionizing the title insurance industry, Doma has developed a machine learning platform, Doma Intelligence, and other technology to automate the title and escrow processes. Initially launched to support mortgage refinancing, Doma has pivoted to adapt its technology to enable “instant underwriting” of title insurance for purchase loans.

Doma founder and CEO Max Simkoff sees a push by the Biden administration to reduce closing costs for borrowers as an opportunity to utilize the company’s technology.

Max Simkoff

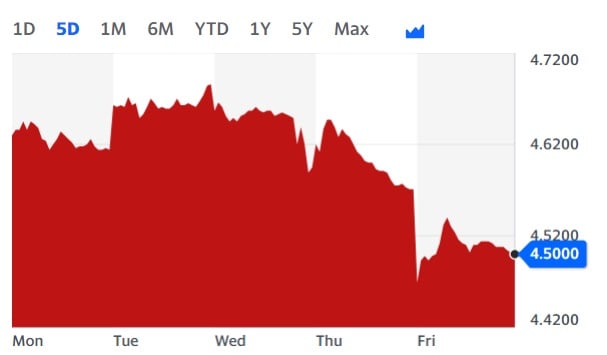

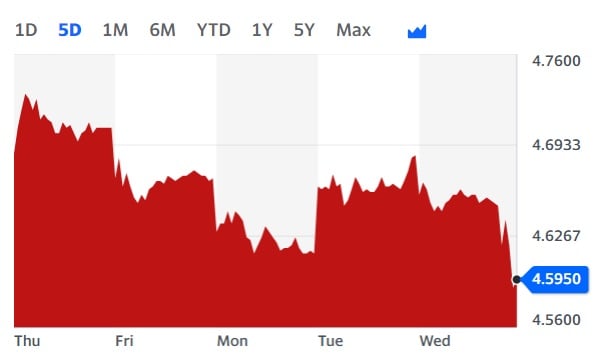

“With mortgage rates at 20-year highs and housing supply severely constrained, many of the largest participants in the mortgage ecosystem — the government-sponsored enterprises, software providers, and national lenders — are seeking new and innovative solutions to reduce closing costs for consumers,” Simkoff said in a statement Tuesday.

“We have long advocated the importance of title insurance and the protection it provides for homebuyers but also the potential for innovation around lenders’ title to lower costs for homeowners. We welcome the focus of Fannie Mae in this area, and believe our scale- and market-tested technology puts us in a leading position to participate in their pilot program.”

Doma’s ups and downs

Doma gained a foothold as a national title insurance underwriter in 2019 with the $171.7 million acquisition of Lennar Corp. subsidiary North American Title Insurance Company (NATIC) and went public in a 2021 merger with a special purpose acquisition company (SPAC) that raised $350 million.

By the end of 2021, Doma employed 2,049 workers, most of whom were located in California, Florida and Texas.

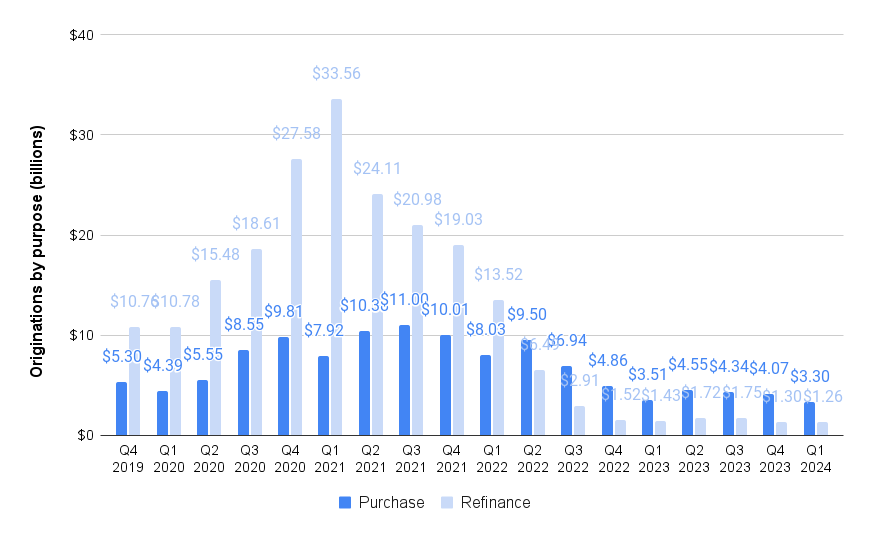

But when the Federal Reserve started raising interest rates to fight inflation in March 2022 and mortgage rates soared, Doma’s mortgage clients saw much of their refinancing business evaporate.

As Doma’s losses mounted, it laid off 1,076 workers in 2022 and eliminated another 70 positions last year in four separate rounds of layoffs. As of Dec. 31, 2023, Doma employed 239 workers, roughly 12 percent of its previous workforce.

Last year, Doma sold 22 retail title locations and operations centers employing 123 workers in Northern and Central California to Williston Financial Group LLC (WFG) for up to $24.5 million — $10.5 million upfront and up to $14 million in earnout payments that come due in June.

Doma also sold title agency and retail title offices located in the Midwest, Texas and Florida to Hamilton National Title LLC, which does business as Near North Title Group and Capital Title of Texas LLC. Those deals provide for up to $2.1 million in earnout payments, the company disclosed in an April 1 regulatory filing.

Doma’s losses peaked in 2022

Source: Doma Holdings Inc. regulatory filings.

Since selling its local retail title agency offices and associated operations nationwide, Doma no longer includes those businesses in reporting headline financial results.

In its latest earnings release, the company reported a $19 million Q1 2024 net loss from continuing operations, compared to a net loss of $18 million in Q4 2023 and a $31.2 million Q1 2023 net loss.

However, Doma’s Q1 2024 net loss using generally accepted accounting principles (GAAP) was $20.6 million, down from $20.8 million in Q4 2023 and $42.1 million in Q1 2023.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.