Real estate brokers didn’t fear the lawsuits — until NAR settled: Intel

Anxiety around commissions leaped to the top of the worries brokerage leaders face, pushing down concerns around inventory and competition, according to Inman Intel Index survey results.

This report is available exclusively to subscribers of Inman Intel, the data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

As the real estate industry digested an unfavorable Sitzer verdict, its leaders had more pressing concerns.

Margins were being squeezed. Hopes of much-needed interest rate cuts were fading. And recruiting had reached a fever pitch.

But the National Association of Realtors sent a jolt through the industry when it announced its settlement in late March, replacing some of those concerns with questions of how brokerages can make money in the first place, according to the Inman Intel Index survey of more than 1,000 real estate professionals.

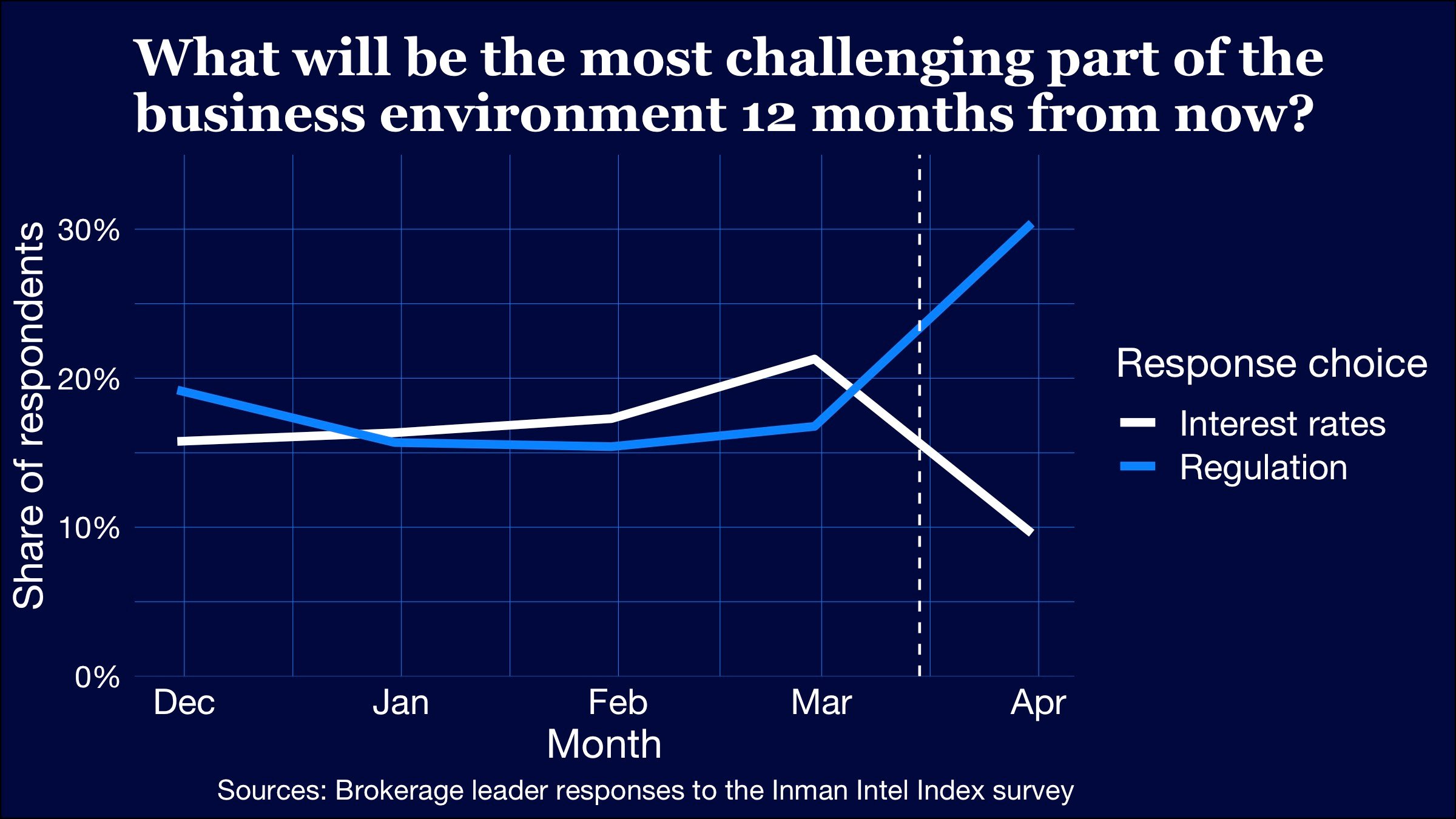

- The share of brokerage owners or executives who told Intel that regulatory issues will be the most challenging part of the business environment over the next 12 months nearly doubled to 30 percent in late March.

- That shift means regulation is, for the first time since the Intel Index launched in September, the No. 1 challenge brokerage leaders say they face over the next 12 months.

This category’s rise came at the expense of anxieties over interest rates, which have moved to the background even as mortgage rates continue to climb and the Federal Reserve signals it may have to delay rate cuts.

Chart by Daniel Houston

The results, collected a little over a week after the settlement details became public last month, represent a mere snapshot in time. Attitudes since then may have shifted.

Even now, Intel is surveying real estate professionals a second time since the settlement to track how persistent this shift is. Take the April survey today, and look out for the results in the weeks to come.

TAKE THE APRIL INTEL INDEX SURVEY

In the meantime, dive into the full breakdown below to learn how NAR’s big news immediately weighed on the thinking of decision-makers at numerous brokerages.

Tomorrow’s problem, today

In one important way, the dynamics have yet to shift.

Brokerage leaders still think that regulatory headaches will be a bigger deal 12 months from now than they are today.

- 17 percent of brokerage leaders told Intel in late March that regulation was the most challenging part of the business environment today, compared to the 30 percent who said it would be the biggest issue a year from now.

Still, even this represents a large shift.

- Between the Sitzer verdict in October and the NAR settlement news in March, the share of brokerage leaders who said regulation was today’s biggest housing challenge had yet to eclipse 8 percent.

That means the latest results — if they hold — show a doubling of the share of leaders who see changes to industry compensation as the No. 1 challenge they face today.

The news also shoved one key brokerage concern a bit further away from the foreground: the risk that interest rates might remain higher for longer.

-

- Prior to NAR’s settlement announcement, approximately 30 percent of broker-owners and executives said interest rates were today’s top concern.

- But in the first Intel survey after the terms of the deal became public, that same share of brokerage leaders dropped suddenly to 20 percent.

As disruptive as brokerage leaders now expect these changes to be, the gap becomes even more pronounced when they’re asked to look ahead at the work ahead over the next 12 months.

A shift in outlook

As a future threat, the lawsuits have been on the minds of real estate leaders for months.

These leaders took seriously its potential to shake up the industry, even as they debated among themselves just how big an impact the litigation was likely to have on their business models and revenues.

Still, for many months, it was just one of a host of issues weighing on their outlooks on their businesses.

Now, regulation has emerged as the single biggest impending challenge brokers say they face.

How the perceived No. 1 challenge for the year ahead has shifted

Average of November-February surveys → March results

- Interest rates: 18% → 10%

- Regulation: 17% → 30%

- Recruiting/retaining talent: 22% → 19%

- Margin compression: 22% → 19%

- Other: 21% → 22%

Above, we can see just how much — and how quickly — regulation has jumped to the forefront of decision-makers’ anxieties.

It’s primarily replaced interest rates, but may also be increasingly top of mind for leaders who have been likely to worry about margin compression or recruiting.

Changes this dramatic require multiple months to assess, which is why Intel will continue to seek insights every month from both the agents at brokerages and the decision-makers who lead them. Take the Intel Index survey for April to lend your expertise to the Inman community.

Methodology notes: This month’s Inman Intel Index survey was conducted March 20-April 1, 2024. The entire Inman reader community was invited to participate, and Intel received 1,009 responses. Respondents for this survey were directed to the SurveyMonkey platform, where they self-identified their profiles within the residential real estate market. Respondents were limited to one response per device, but there was no limitation to IP addresses. Once a profile (residential real estate agent, mortgage broker/banker, corporate executive/investor/proptech, or other) was selected, respondents answered a unique set of questions for that specific profile. Because the survey did not request demographic information for age, gender or geography, there was no data weighting. This survey will be conducted monthly, with both recurring and unique questions for each profile type.