Agents say their brokerage has their back amid commission mess

The NAR settlement shook the industry, but agents overwhelmingly told the Inman Intel Index they believe their brokerage has been an effective ally. It’s a big win for brokerage training efforts.

This report is available exclusively to subscribers of Inman Intel, the data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

The mad dash for broker-owners and executives to respond to the array of changes to commissions in recent months has paid off in at least one crucial way: Agents feel their brokerage has their back.

Real estate agents who responded in late March to the Inman Intel Index broadly reported feeling that their brokerage has prepared them for the changes from the commission lawsuits and settlements, and will continue to offer them the resources they need.

Agents also told Intel they are confident they can articulate their value to clients amid this new landscape, in which buyer-side compensation is increasingly up for negotiation.

These results are notable because they came from a time when the industry was already processing a major new shift in the dynamic of the lawsuits.

NAR had announced a settlement and a series of sweeping policy changes only days before Intel surveyed more than 1,009 real estate professionals for this story.

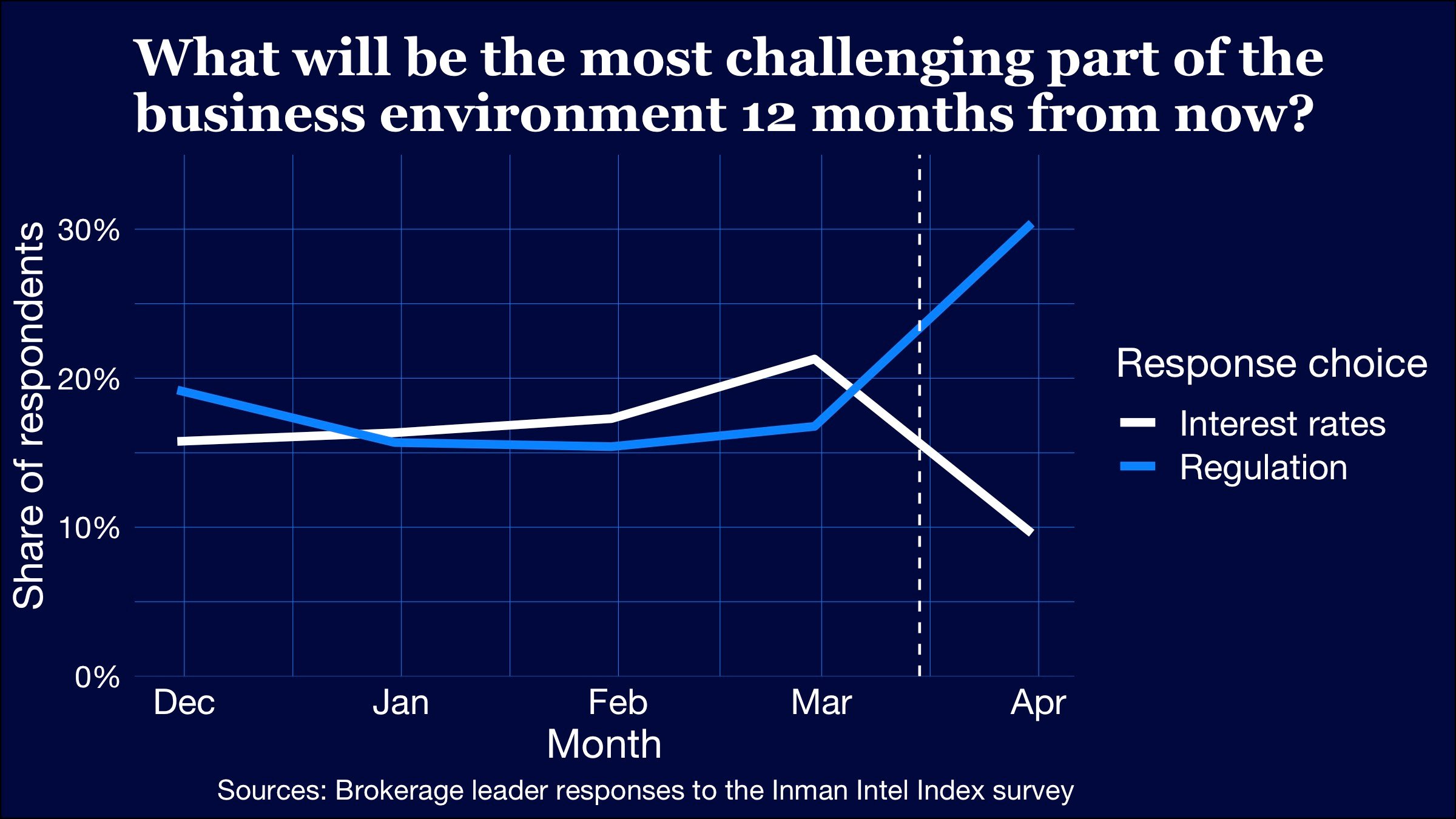

As Intel reported last week, this appears to have contributed to a drop in agent confidence in future buyer pipelines. It also coincided with a rising tide of brokerage leaders reporting that their top concern in this down market was regulation, not interest rates.

But even if agents expressed these concerns, they were not critical of how their brokerages have helped them navigate these waters.

Read the complete breakdown in the report below.

An overwhelming consensus

Given the anxieties felt by many in the industry, it wouldn’t have been a surprise for agents to take some of those out on their brokerage leaders.

But that’s not what happened in late March.

- 73 percent of agents who responded to the Inman Intel Index agreed with the idea that their brokerage has done “everything it can” to help them navigate the changes from the lawsuits.

- Only 11 percent actively disagreed with the notion their brokerage had done all it could.

- The remaining respondents told Intel that they neither agreed nor disagreed.

Even more lopsided were agent responses to how prepared they personally feel for an environment where clients have more leeway to negotiate their compensation.

- A whopping 93 percent of agents in March told Intel they agreed with the idea that they could “clearly and confidently” convey their value to clients. More than 58 percent of all agent respondents “strongly” agreed with that statement.

- Only 1 percent of agent respondents disagreed with the idea that they could clearly and confidently demonstrate their value.

Clearly, in the wake of all this change, brokerages have been doing something right. Intel asked for more details to help fill out the picture.

How they did it

It all starts with training.

Since its launch in September, the Inman Intel Index has tracked what brokerages have been doing in the wake of the Sitzer | Burnett verdict and related developments.

Now, agents already have months of training under their belts as the changes from the NAR settlement approach.

- 71 percent of agent respondents in late March told Intel that they agreed their brokerage had provided “thorough and ongoing” training as the commission lawsuits have progressed.

Still, this is an area where a greater share of agents did express some level of dissatisfaction.

- 14 percent of agents told Intel they disagreed with the idea that their brokerage’s training has been thorough and ongoing, suggesting that roughly 1 in 7 members of the surveyed Inman community felt left behind when it comes to training.

For the vast bulk of the industry, that training has focused on at least three key points: using buyer agency agreements, demonstrating an agent’s value to buyers and negotiating compensation.

- More than 76 percent of agent respondents agreed their brokerage has trained or continues to train them on these three things in particular.

- A little over 12 percent actively disagreed, signaling they felt their brokerage had not provided enough training resources in these key areas.

Backing out, Intel asked a broad question meant to capture the industry’s general feelings of preparedness for the challenges to come.

- 78 percent of agent respondents told Intel they believe they have “all the tools and resources” they need, and are confident they will continue to receive them from their brokerage.

- Only 6 percent disagreed with this statement.

Intel continues to track these issues in its monthly sentiment survey. The results of the most recent survey, which concluded this week, will be available to subscribers soon.

Methodology notes: This month’s Inman Intel Index survey was conducted March 20-April 1, 2024. The entire Inman reader community was invited to participate, and Intel received 1,009 responses. Respondents for this survey were directed to the SurveyMonkey platform, where they self-identified their profiles within the residential real estate market. Respondents were limited to one response per device, but there was no limitation to IP addresses. Once a profile (residential real estate agent, mortgage broker/banker, corporate executive/investor/proptech, or other) was selected, respondents answered a unique set of questions for that specific profile. Because the survey did not request demographic information for age, gender or geography, there was no data weighting. This survey will be conducted monthly, with both recurring and unique questions for each profile type.