- Originally published at Inman News - Chris LeBarton

Brokerage leaders are still waiting to see the returns on their 2023 technology investments, according to the latest results from the Inman Intel Index. Read on for the biggest takeaways.

This report is available exclusively to subscribers of Inman Intel, the data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

The real estate technology arms race to keep up with the competition — not to mention keep talent — continues apace.

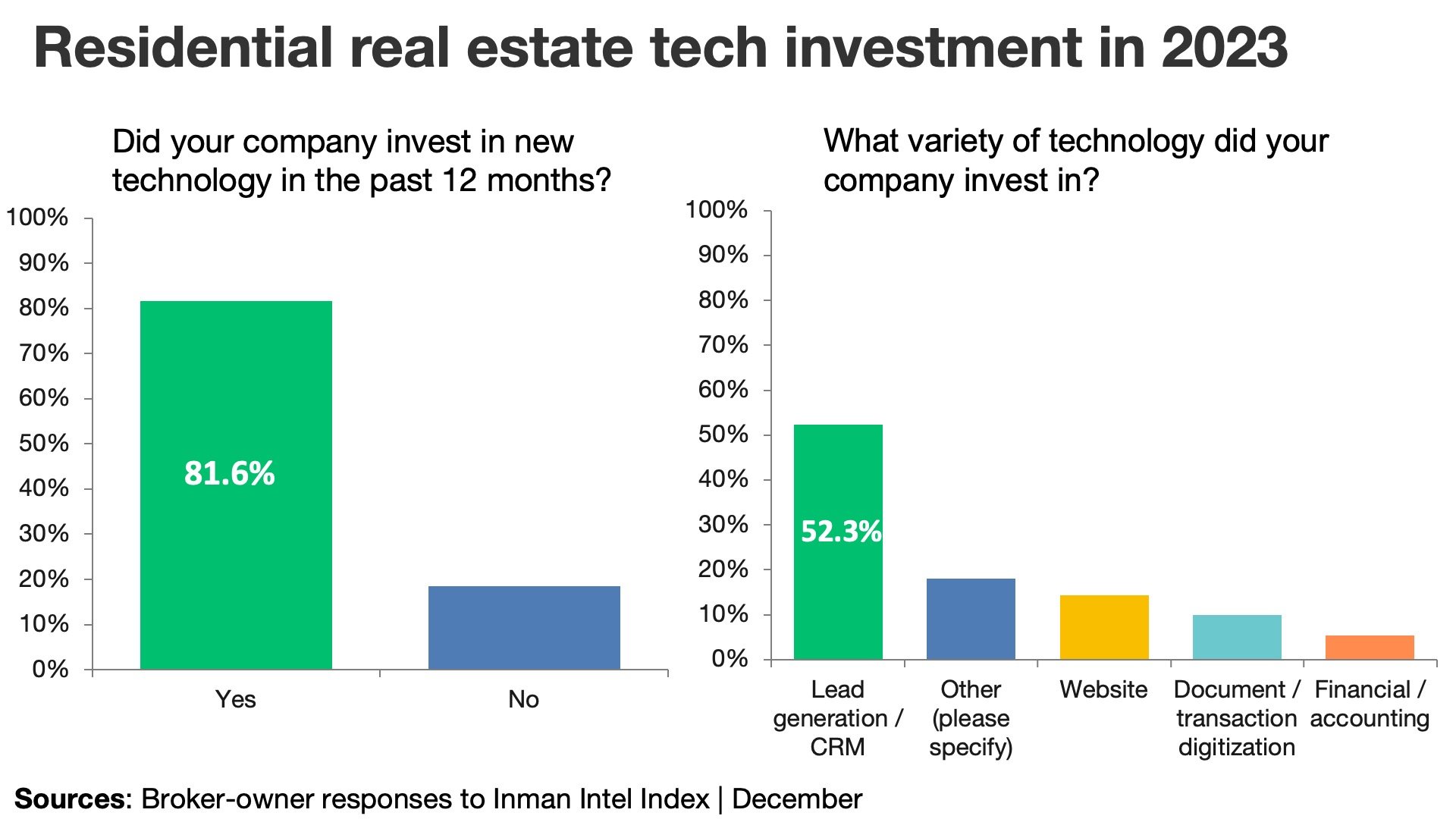

More than 8 out of 10 real estate company leaders invested in technology in 2023, and 75 percent said they would do so this year, according to the December Inman Intel Index survey.

That survey, also known as the Triple-I, additionally revealed that over 60 percent thought it was too soon to evaluate the return on their 2023 tech investment.

Considering over half who did invest spent money on lead generation and customer relationship management software, a delayed payoff is unsurprising. But it comes against the backdrop of one of the slowest years in home sale history.

But this delayed gratification is not simply because of the recent housing downturn. Intel found that waiting for investment payoff is just one of many layers of friction real estate companies encounter before and after deciding to ante up for tech.

If you buy it, they will (maybe) use it

Asked for their biggest challenge in implementing technology, 40 percent of broker-owners named “Buy-in / adoption from users” as the preeminent challenge. That share was nearly double that of each of the next two closest choices: “researching what technology is best” and “cost.”

The outsized challenge of technological adoption isn’t unique to residential real estate, but some structural issues exacerbate the problem. This includes the nature of how industry information has traditionally been shielded and shared.

While public companies and REITs do, as obligated, provide vast quantities of data to investors, real estate agents and brokers are instinctively trained to protect any information not required to be entered into an MLS. Similar to comps and cap rates in the commercial real estate world, local knowledge and insights are agents’ gold. They are loathe to share anything that might become public or help the competition.

A related point on demographics is double-edged one. Experience is often what consumers value most in a real estate agent, and industry leaders constantly reinforce the idea that decades of human experience present a firewall that artificial intelligence can never fully breach.

According to the National Association of Realtors, the median age of its membership is 60. For some, conquering Facebook Live is an achievement; implementing multiple software systems, familiarizing themselves with blockchain technology, and finding time to learn generative AI prompts could be a digital bridge too far.

According to NAR’s 2023 Technology Survey:

- Thinking back on the last 12 months, respondents found that these technology tools used in their businesses were very impactful: eSignature (79 percent), lockbox/showing tech (66 percent), and cloud storage (48 percent).

- 92 percent of respondents use Facebook in their real estate business, 68 percent use Instagram, 52 percent use LinkedIn, and 26 percent use YouTube.

- The top three tech tools that have given respondents (or their agents) the highest number of quality leads in the last 12 months were social media (54 percent), customer relationship management (36 percent), and their local MLS (24 percent).

- Respondents found that these technology tools provided by their brokerage were very valuable: eSignature (67 percent), Lockbox/Showing tech (53 percent), transaction management (45 percent), and video conference (40 percent).

- 52 percent of respondents were not at all familiar with Blockchain. 32 percent of respondents believe that Blockchain technology will have an impact on real estate in three to five years.

- 54 percent of respondents were somewhat familiar with AI. 44 percent of respondents believe that AI currently has an impact on real estate.

Where’s the lead?

Over 52 percent of broker-owner respondents to December’s Triple-I who invested in technology specifically isolated lead generation and CRM software, but several who selected “Other” listed those two things.

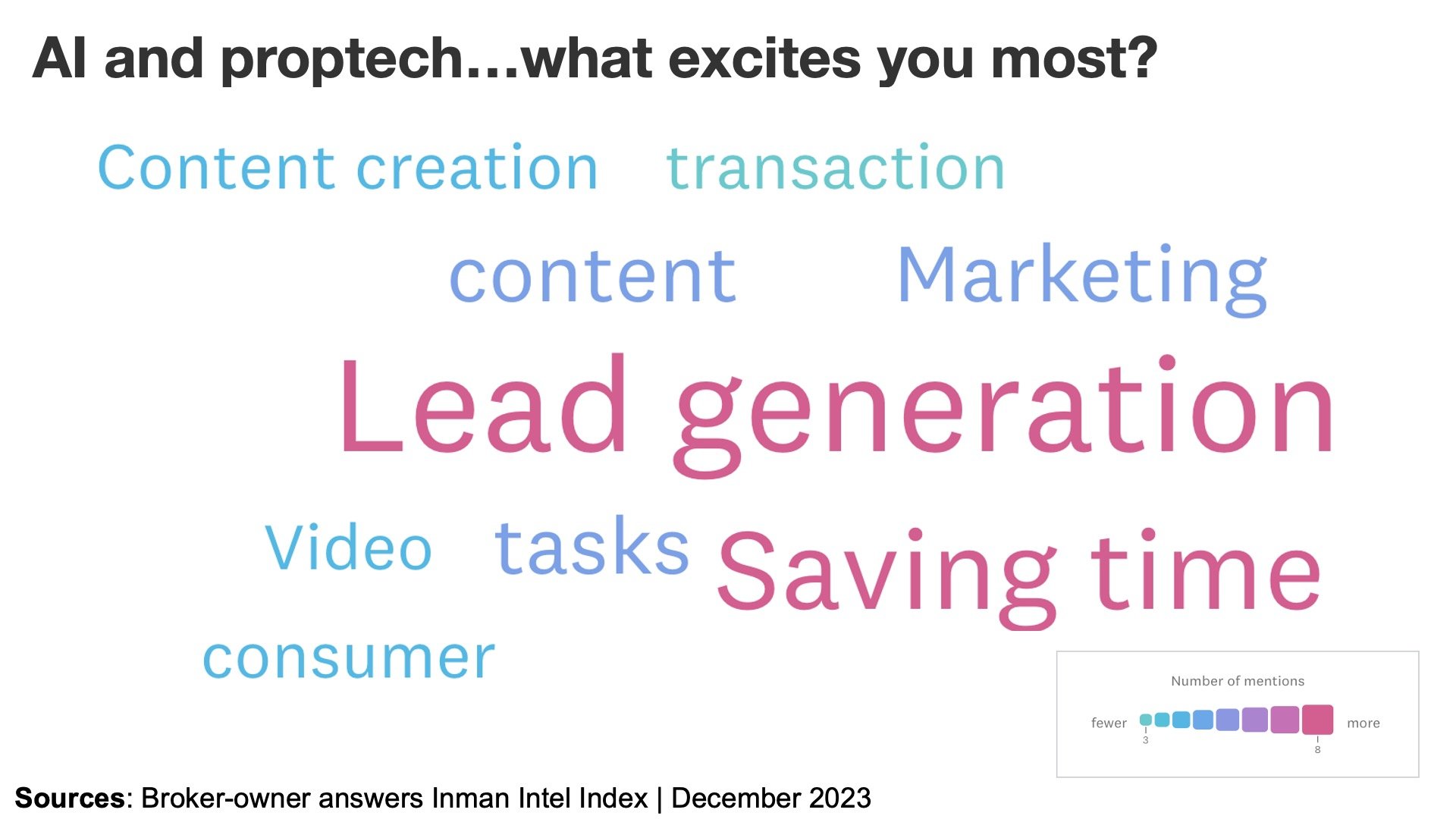

Further solidifying that lead generation software and CRM toolkits are top of mind for many brokerage leaders, “lead generation” stood out in an open-ended question about what excites them the most about artificial intelligence and proptech.

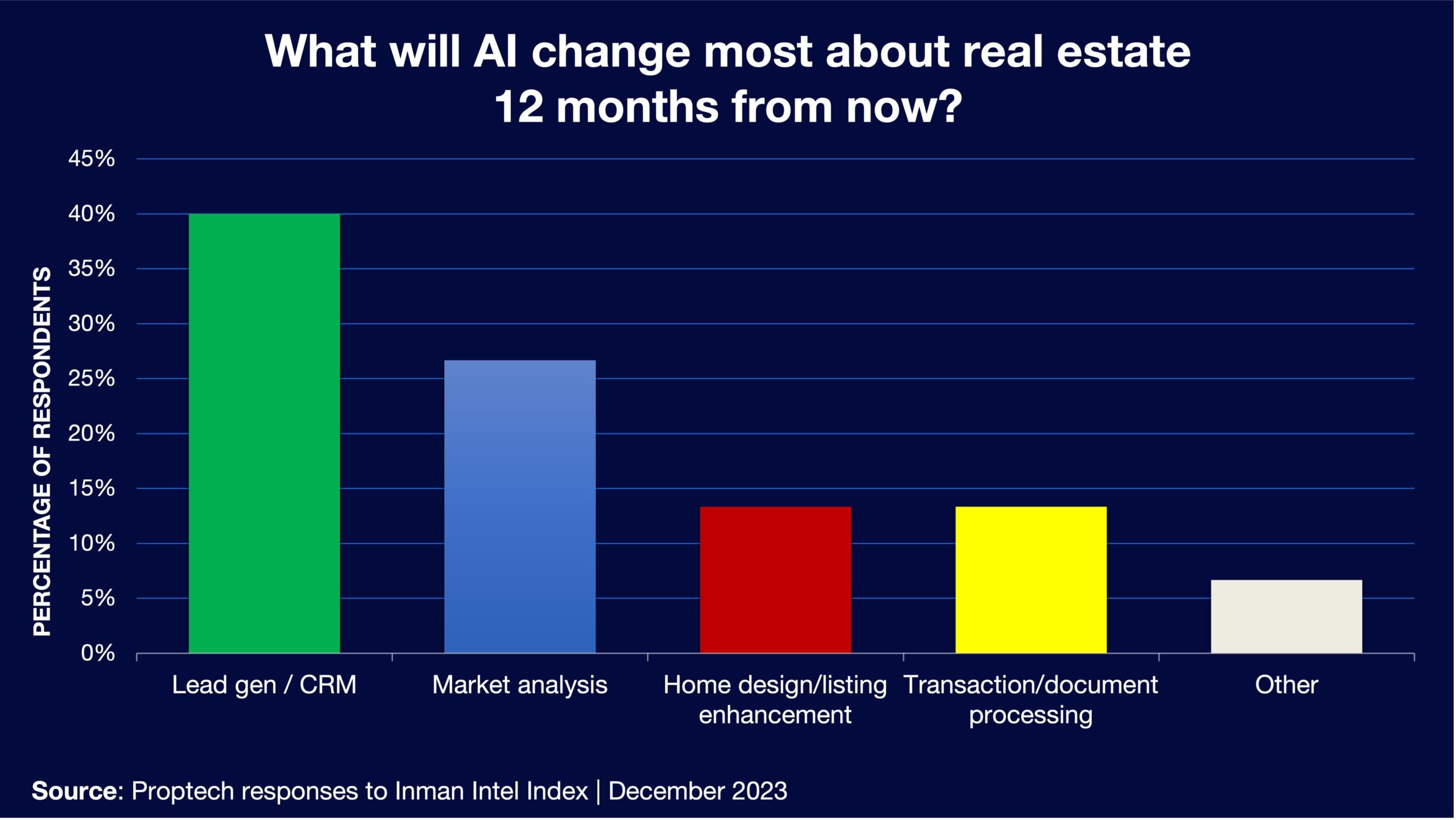

It’s not just the consumers who are eager to see what technology can do to advance the world of lead acquisition and client relationship management. About 40 percent of proptech respondents said that lead generation and CRM technology will be impacted most by artificial intelligence 12 months from now.